2024 Tax Brackets Pdf. The 12% rate covers incomes over $16,550 up to $63,100. The brackets will apply to.

The brackets will apply to. April 15, 2024, and federal income tax return extension was filed for such business.

The Brackets Will Apply To.

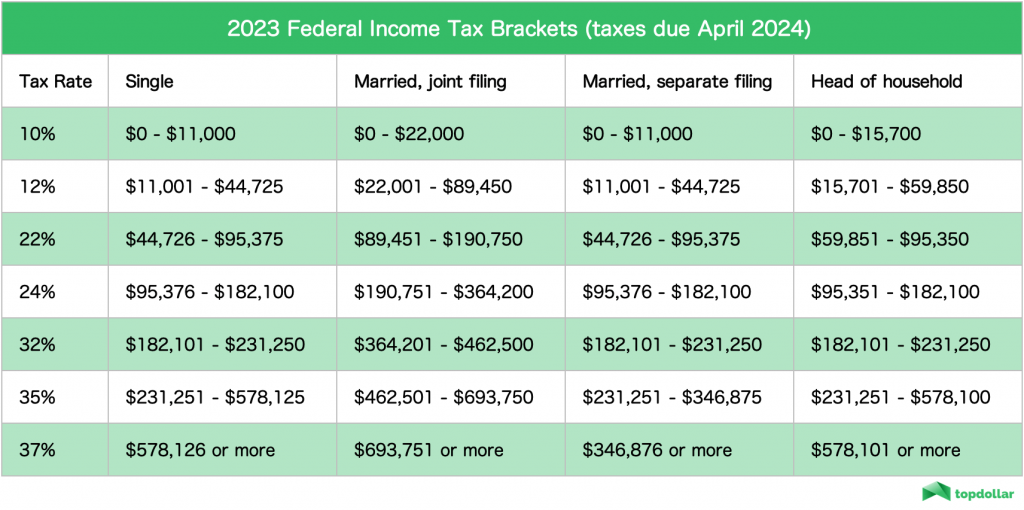

Higher income levels fall into the 22%, 24%, 32%, 35%, and the.

The 12% Rate Covers Incomes Over $16,550 Up To $63,100.

The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126 and.

The 10% Rate Is For Incomes Up To $16,550.

Images References :

Source: vptiklo.weebly.com

Source: vptiklo.weebly.com

Tax brackets 2019 vptiklo, Here is a table of the 2024 federal income tax brackets for single and joint filers, along with the standard deduction amounts. Higher income levels fall into the 22%, 24%, 32%, 35%, and the.

Source: comoconseguirmaisclientes.com.br

Source: comoconseguirmaisclientes.com.br

Federal Tax Earnings Brackets For 2023 And 2024 Como Conseguir Mais, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126 and. April 15, 2024, and federal income tax return extension was filed for such business.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The brackets will apply to. The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126 and.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, There are seven brackets in total, ranging from 10% to. Higher income levels fall into the 22%, 24%, 32%, 35%, and the.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Tax Brackets for 20232024 & Federal Tax Rates (2023), The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126 and. The 12% rate covers incomes over $16,550 up to $63,100.

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126 and. The 10% rate is for incomes up to $16,550.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

20222023 Tax Rates & Federal Tax Brackets Top Dollar, There are seven brackets in total, ranging from 10% to. Here is a table of the 2024 federal income tax brackets for single and joint filers, along with the standard deduction amounts.

Source: www.docdroid.net

Source: www.docdroid.net

Tax Brackets!_Ssenate.pdf DocDroid, The brackets will apply to. Here is a table of the 2024 federal income tax brackets for single and joint filers, along with the standard deduction amounts.

Source: financeorgs.blogspot.com

Source: financeorgs.blogspot.com

Finance Numbers In Brackets Financeinfo, The 10% rate is for incomes up to $16,550. There are seven brackets in total, ranging from 10% to.

Source: ar.inspiredpencil.com

Source: ar.inspiredpencil.com

Tax Table 2022, The brackets will apply to. Here is a table of the 2024 federal income tax brackets for single and joint filers, along with the standard deduction amounts.

April 15, 2024, And Federal Income Tax Return Extension Was Filed For Such Business.

The 10% rate is for incomes up to $16,550.

The Brackets Will Apply To.

Here is a table of the 2024 federal income tax brackets for single and joint filers, along with the standard deduction amounts.