Do You Claim Exemption From Withholding For 2024 Meaning. A withholding allowance was like an exemption from paying a certain amount of income tax. If you meet certain criteria, such as having no tax liability in the.

It is linked to personal. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck.

Are My Wages Exempt From Federal Income Tax Withholding?

If you meet certain criteria, such as having no tax liability in the.

In Addition To Meeting Income Requirements, You Must Have Received A Full.

Claiming an exemption from federal withholding is simple.

One Can Open A Tax Saving Fd Via Net Banking And Claim Income Tax Exemption.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Exemption from 2023 federal tax withholding certificate expires february 17, 2024. The exemption applies only to income tax, not to social security or.

Source: www.mdtaxattorney.com

Source: www.mdtaxattorney.com

How Do I Know if I Am Exempt From Federal Withholding? SH Block Tax, In addition to meeting income requirements, you must have received a full. One can open a tax saving fd via net banking and claim income tax exemption.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, To continue to be exempt from. So when you claimed an allowance, you would essentially be.

Source: www.youtube.com

Source: www.youtube.com

Do You Claim Exemption From Federal Tax Withholding, So when you claimed an allowance, you would essentially be. Are my wages exempt from federal income tax withholding?

Source: www.youtube.com

Source: www.youtube.com

How to Fill Out an Exempt W4 Form 2024 Money Instructor YouTube, Exemption means you don't owe any tax at all, not that you don't pay tax when you file your tax return. This interview will help you determine if your wages are exempt from federal income tax withholding.

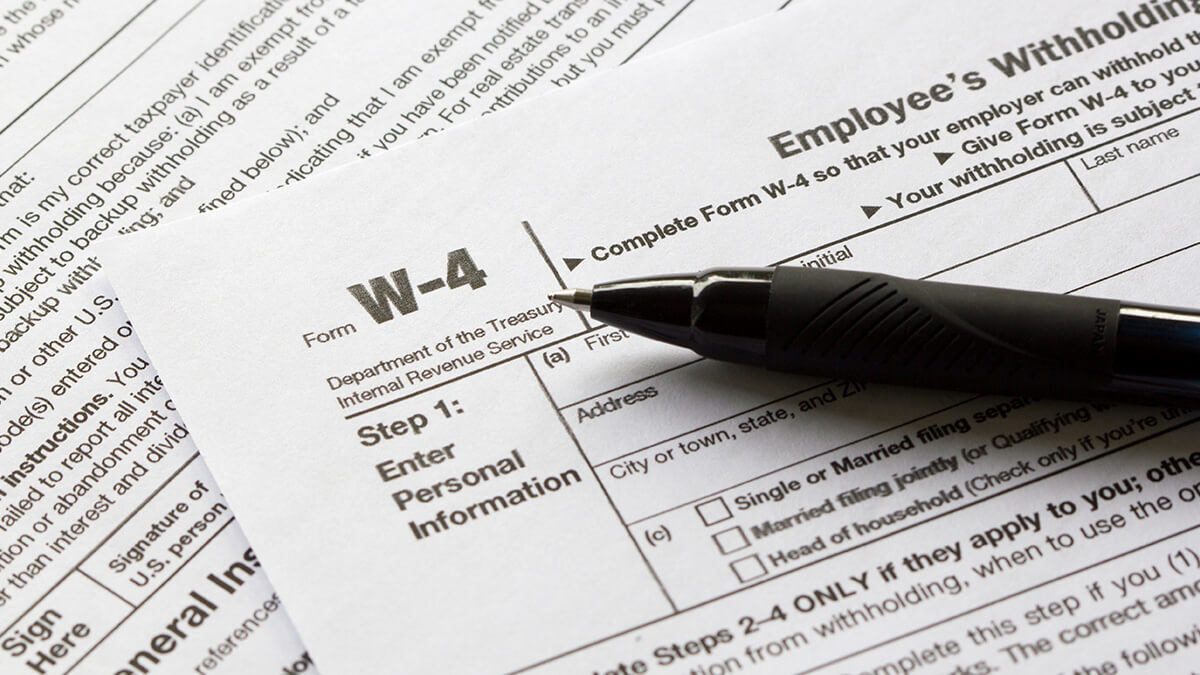

Source: taxcognition.com

Source: taxcognition.com

Tax Withholding Exemptions Explained Top FAQs of Tax Jan2023, You may be able to claim. In addition to meeting income requirements, you must have received a full.

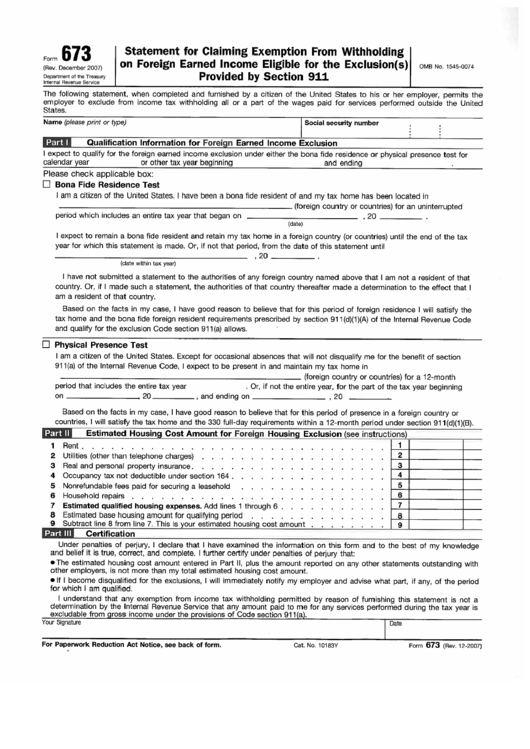

Source: www.formsbank.com

Source: www.formsbank.com

Fillable 673 Form Statement For Claiming Exemption From Withholding, If you claim exempt and actually owe, you have to pay it when you file. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you don't claim exempt,. In the prior year, they had.

Source: www.springfieldnewssun.com

Source: www.springfieldnewssun.com

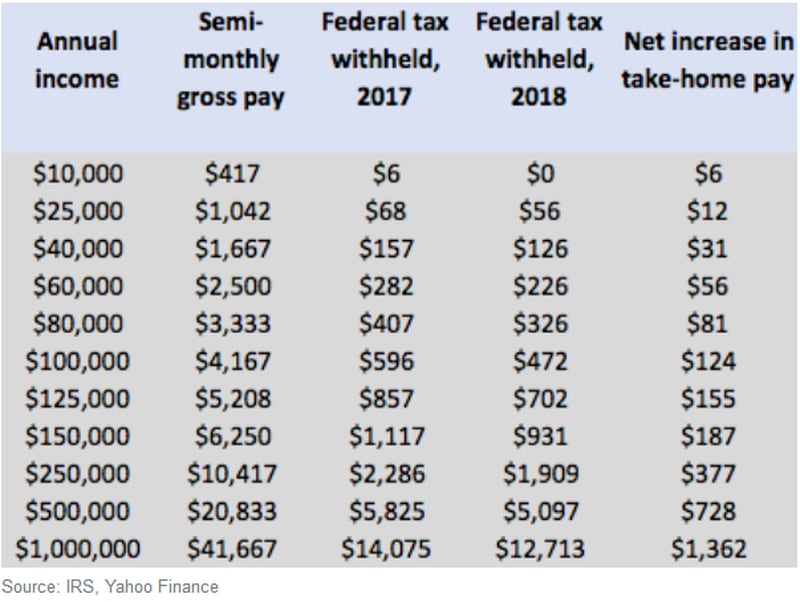

Here's why there's more money in your paycheck, Claiming tax exempt means that no federal tax will be withheld from your paychecks. Exemption means you don't owe any tax at all, not that you don't pay tax when you file your tax return.

Source: content.moneyinstructor.com

Source: content.moneyinstructor.com

How to Fill Out an Exempt W4 Form 2023 Money Instructor, If too much money is withheld throughout the year,. A withholding allowance was like an exemption from paying a certain amount of income tax.

In Addition To Meeting Income Requirements, You Must Have Received A Full.

When you file as exempt from federal withholding, the government will stop withholding federal income taxes from your paychecks.

Withholding Tax Is Tax Your Employer Withholds From Your Paycheck And Sends To The Irs On Your Behalf.

In the prior year, they had.